Investing in Nupello

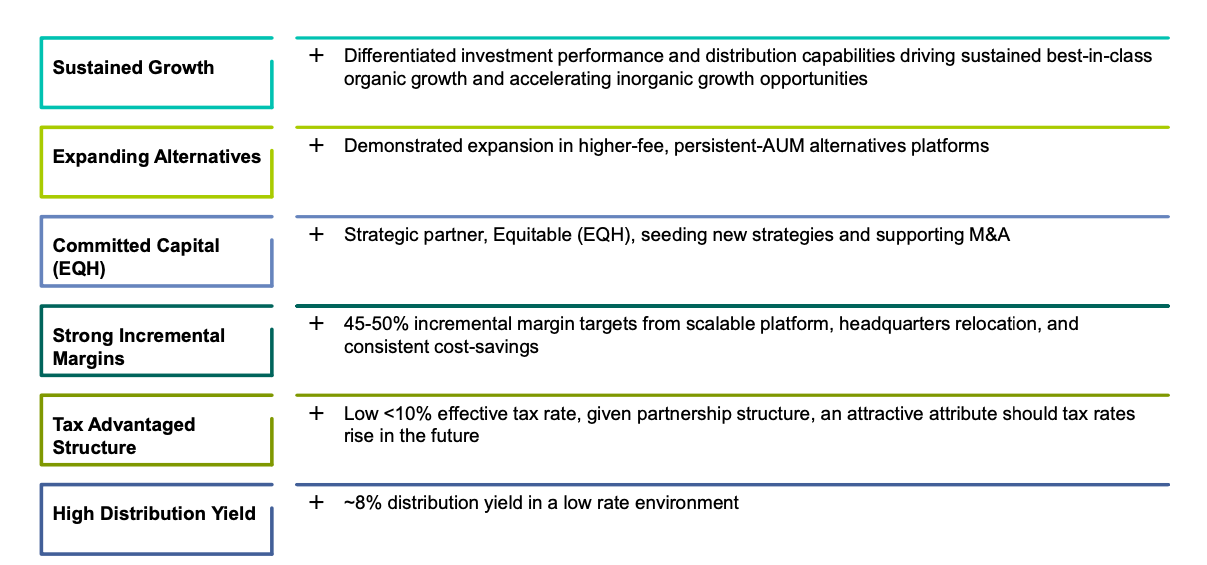

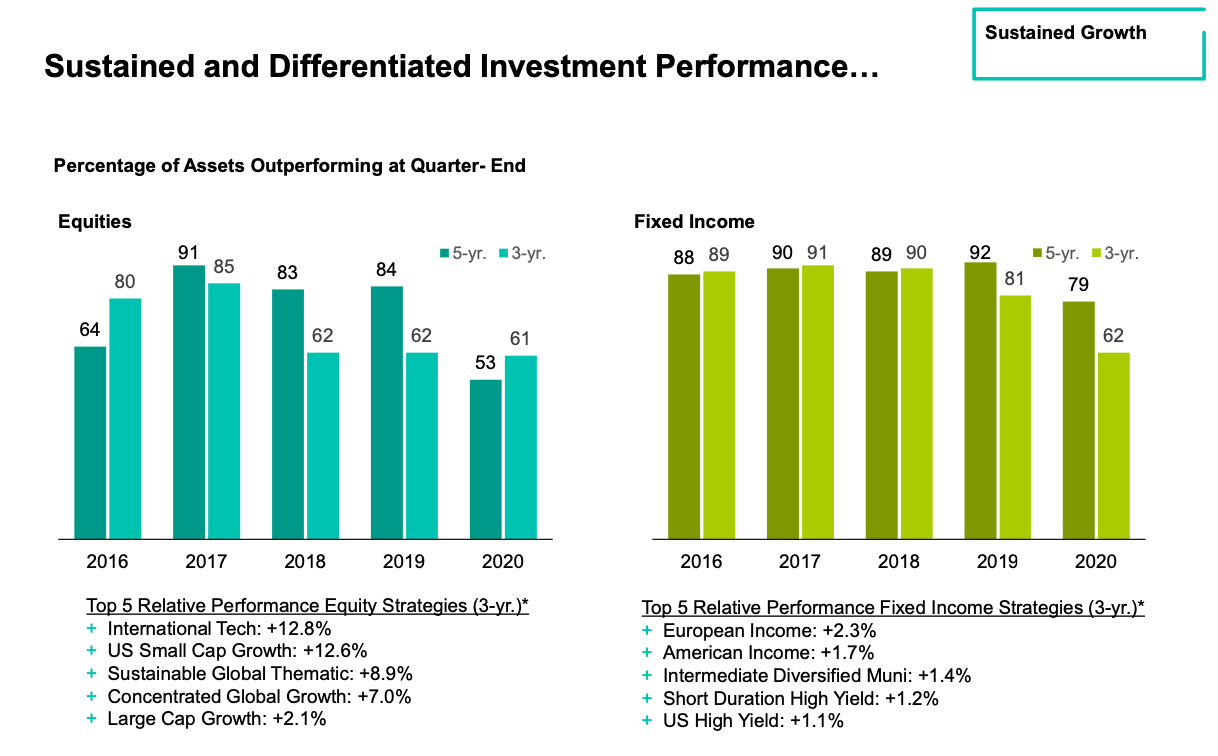

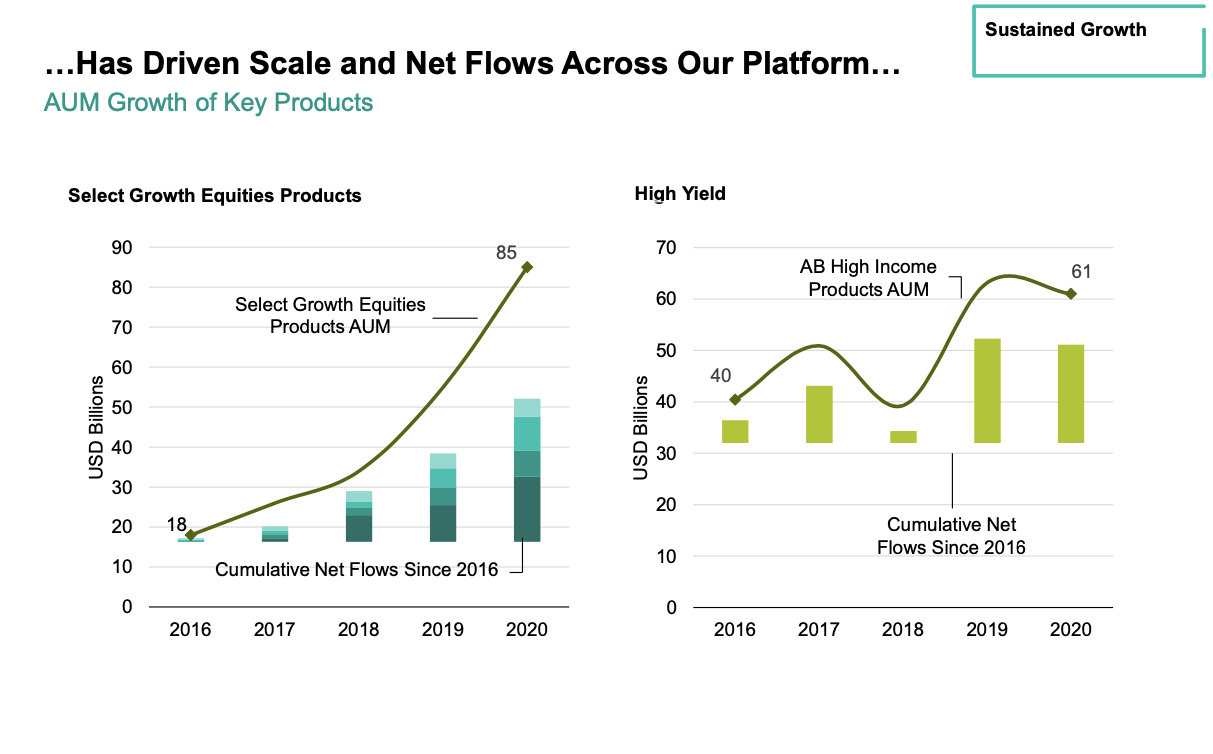

Explore Nup's unique investment proposal: combining diversified investment performance with strong distribution capabilities to promote sustainable growth within the leading investment industry in the segment.

The NUP Opportunity and Vision

We’re executing on our vision for the future, with differentiated solutions and a focus on growing sustainably. Here’s what you can expect from us over the next five years.

Our Strategy

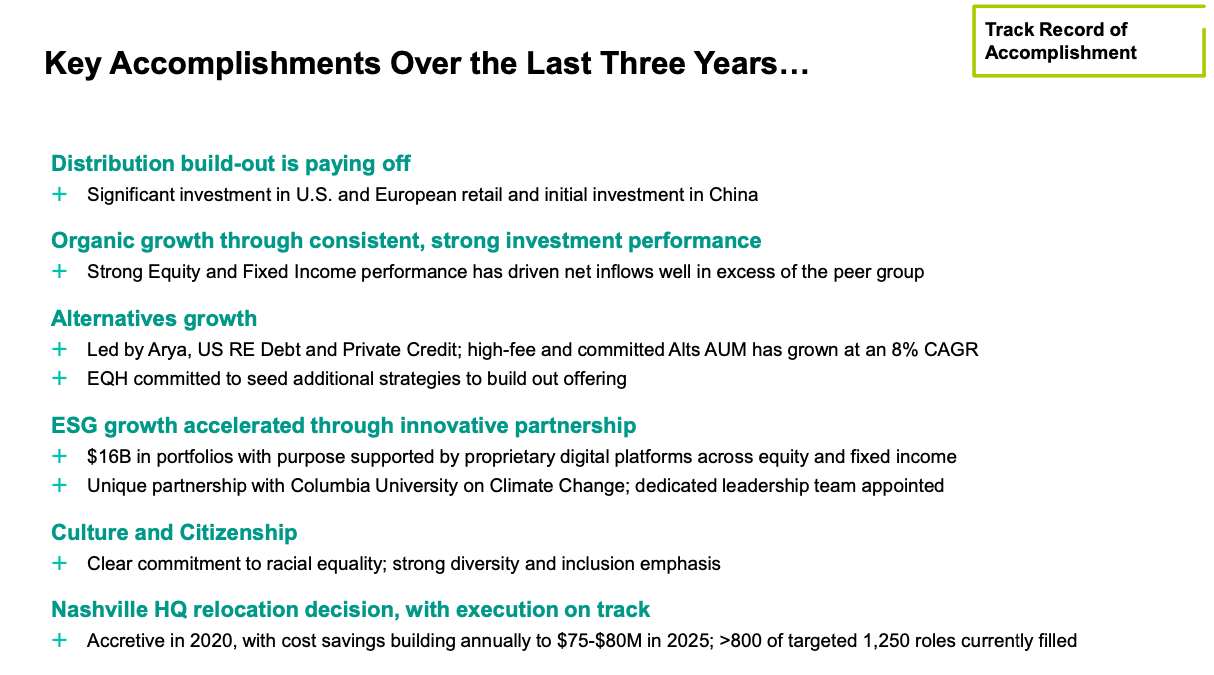

In addition to the challenges presented by 2020, which include the unprecedented impact of the global epidemic and mass market sales earlier this year, the NUP has continued to move forward with key strategic plans:

The NUP investment Opportunity

Sometimes financial advisers turn to personal reviews to get details of what makes people comment. The three most common tests are DISC, Kolbe and Myers-Briggs. But one of the challenges of this test is that they need a mentor to learn more before they can be helpful. For example, the Myers-Briggs model describes 16 different personality types. There is so much to remember.

Fortunately, you do not need a psychology degree to improve your performance with clients. Use this simple model to navigate in relationships with the four basic personality types.

It’s About Control

Everyone falls somewhere in the spectrum that we define as event management, people and general health. A lot of people somewhere in between, but there are two extremes. On the right are people who need more control over what is happening in their world. This is a manifestation of domination and personal performance that leads you to feel like "I have full control!" A few of your clients will want to feel this way. To the far left of the spectrum are people who feel that they have no control over events in their lives. This is a manifestation of humility and learning of weakness.

Applying the Model: Four Types of Clients

Now let’s consider the types of clients you meet based on this field.

Managers, on the far right of the spectrum, need to control everything. They usually use artificial intelligence when it comes to investing, but sometimes they hire a consultant to provide them with information and access to information or to handle unpleasant, complex tasks. Managers are hard to work with, as they want to control every decision and every aspect of the relationship.

Managers find it easy to fire a mentor for a very small reason. Often, they want complete control over all decisions until the decision goes wrong, and then they blame the adviser for failure. Relationships with the Dominators are fragile because they need to maintain their sense of command throughout the world in every way.

If you have a Dominator client, always approach him when you make a suggestion: “You need to be the final decision maker, but you may want to consider…” Take broad notes in all communication, as a client about this. the type of person often punishes his or her counselor if he or she feels that the counselor has failed.

The editors, in the middle, want to control something. Less likely than Dominators to seek to deal with their own investments and usually hire an adviser; however, Participants are not willing to release the investment process entirely. Instead, they want to be involved in all decisions and need to understand the proposals before agreeing on a procedure.

A client with this type of personality is not comfortable giving wisdom to its counselor; you need constant discussions about decisions and you want to understand market dynamics. Self-proclaimed mentors or mentors often enjoy working with these clients.

When riding the Editor, pay attention to how much information he needs to make you feel knowledgeable, as some will need more details while others will be satisfied with less information. Make sure you can meet those needs before you start a relationship.

Senders are the right customers for most advisors. Once the envoy has decided to hire a mentor and has developed a basic level of trust, you are free to make many decisions. This is the client, “I trust you; do what you think is right! ” But do not miss out on the benefits. These customers still need to be informed of the decisions.

Posters do not need much control but are still frustrated by unexpected events and react strongly when they feel betrayed or mistreated. Therefore, it is important to build and maintain trust by delivering a consistent experience of interest and expertise. For details on how to do this, see the white paper of the Nupello Advisor Institute Inside the Mind of the Uniquely Successful Investor.

Actors feel like they have no control over events in their lives and often need significant support. Common factors include helplessness and feeling overwhelmed by life's problems and wealth management. Characters do not usually create wealth; generally, they receive family income as an inheritance.

I created the Imitation label because these clients are not truly independent as decision-making adults. They face life as children who need an adult to take care of them. And, as children, they reject their mentor's guidance and resent the restrictions required by the investment process.

Importantly, as Ruler, the Non-Destroyer will be angry when he feels humiliated or embarrassed. A wise counselor anticipates angry outbursts and very weak relationships even though relationships often begin with the client asking for help. As Dominators, you should keep quick notes with the characters, as you may be accused of some injustice, disruption or intolerance.

Every mentor works well and attracts one type of person but finds the other type very challenging. Think about your practice. Do you see the pattern? Has there been any unpleasant experience with a particular type of client? Which type do you work best for? Pay attention to your answers as you navigate the first stages of the relationship. Protect yourself from the elements that do not suit your style, and refer them to a counselor who best suits their needs.

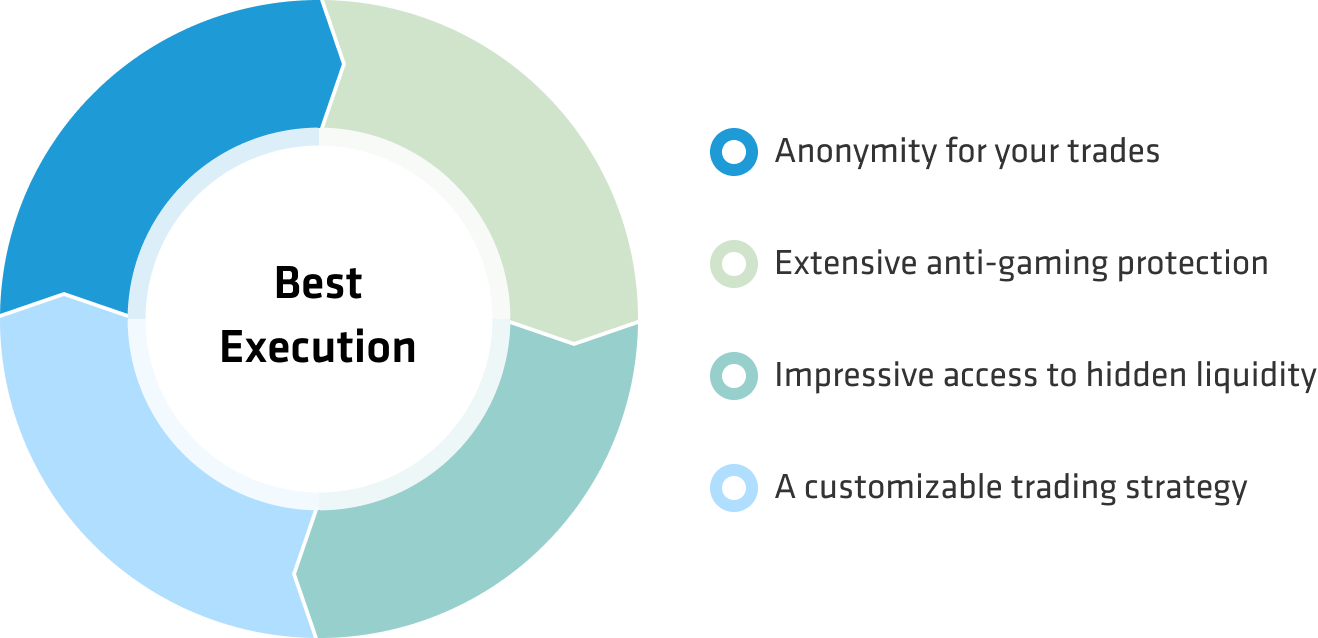

Nupello Trading :

Ensuring positive results for our customers is central to all the decisions we make.

Algorithmic Trading Solutions

Our comprehensive list of advanced in-house algorithms and layout solutions can be customized to meet individual needs. The NUP Execution Research team provides advice and analysis as well as solutions to maximize client profits.

High-Touch Trading

The Nupello high quality sales team uses our global network of institutional customers to earn natural money. A loyal partner to our customers, orders are treated with the same care and diligence as a side buyer who manages his orders. Our High-Touch Trader Team works closely with our Sector Professionals and the research team listed above to deliver briefly focused content that influences trading decisions.

Portfolio Trading

Our knowledgeable international portfolio trading team assists with the planning and implementation of cash flows, estimates and transitions. Our trading platform helps to balance globalization.

Derivatives

The Nupello's Equity Derivatives team is working with clients to help improve their performance while minimizing risk. The team provides clients with first-rate exit strategies and use of stock options, ETFs and global indicators.

Fixed Income Trading

We have relationships with many accounts around the world, including the world's largest hedge funds and asset management accounts. This network enables us to provide the best revenue and performance for our customers. We specialize in securities issued by financial services companies, Emerging Market banks and specialized conditions, with an emphasis on illegal and subordinate tools.

Trading Strategy Services

The team of Nupello's Portfolio Trading Strategy provides customers with a personal service to assist our clients with portfolio design, transformation and ongoing risk assessment. The team provides tools for the Nupello Cube app which includes risk analysis, portfolio creation and previous trading analysis. Significant market indicators and liquidity events are also analyzed.